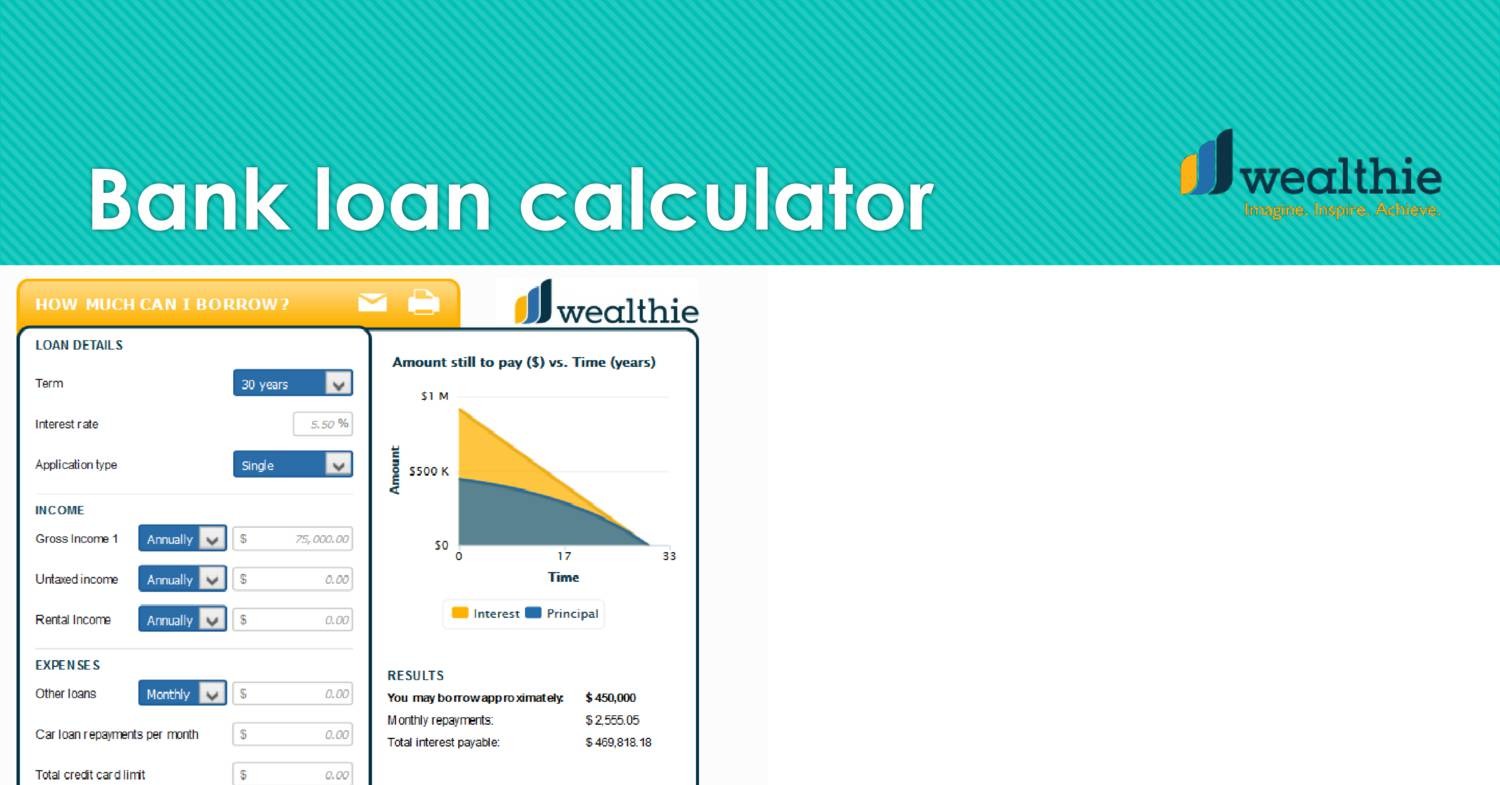

Take some time to experiment with different. Please speak to a TD banking specialist about your particular needs. This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. This calculator can be used for mortgage, auto, or any other fixed. Information such as interest rates quoted and default figures used in the. Speak to a TD representative for more information on which solution may be right for your borrowing needs!Ĭontent in this video is for informational purposes only and may vary based on individual circumstances. Simply enter the loan amount, term and interest rate in the fields below and click calculate. The Calculator is for illustration purposes and for self-evaluation only. Just answer a few quick questions and well provide your estimated monthly. To find out what you will pay monthly and in total, simply insert: The loan amount (the total amount of money you want to borrow) The loan length (how long you want to repay the loan) The likely interest rate. Use the M&T Personal Loan Calculator to help you estimate your monthly payments.

If, on the other hand, you need the flexibility to borrow for a variety of needs, without having to reapply every time, then a line of credit may be a better option – as the funds up to your available credit limit are there, whenever you want! And you only pay interest on what you use. MoneyHubs calculator can work out the cost of personal loans that can be paid back over periods of between 1 - 5 years.

You can choose a fixed or variable interest rate… and select your payment frequency ranging from weekly to biweekly, semi-monthly or monthly. It provides a lump sum of money up front. Use our Isle of Man Bank loan calculator to estimate how much you could borrow, see our representative interest rates and what your monthly payments might. To help you decide which financial lending option might be right for you, keep the following in mind:ĭo you have a well-defined borrowing need with a particular end goal – such as buying a car, consolidating debt or another major expense? Then a loan might be a better option. When it comes to borrowing needs – there’s no one size that fits all.

0 kommentar(er)

0 kommentar(er)